Hawk tuah girl cryptocurrency lawsuit

The Bank for International Settlements summarized several criticisms of cryptocurrencies in Chapter V of their 2018 annual report. The criticisms include the lack of stability in their price, the high energy consumption, high and variable transactions costs, the poor security and fraud at cryptocurrency exchanges, vulnerability to debasement (from forking), and the influence of miners roxy palace bonus codes.

Although cryptocurrency is defined as a form of “digital currency”—implying it’s a kind of money—most businesses and consumers have not adopted it as a common medium of exchange. In other words, most stores will not accept crypto as a form of payment.

Another way to manage your risk, particularly when you’re new to crypto investments, is to set aside a portion of investable funds. For example, if you have $100 to invest, start investing a small percentage of that money in crypto. Doing so gives you time to get a feel for how the market works while actively participating. It also gives you a bankroll on reserve to work with on future trades.

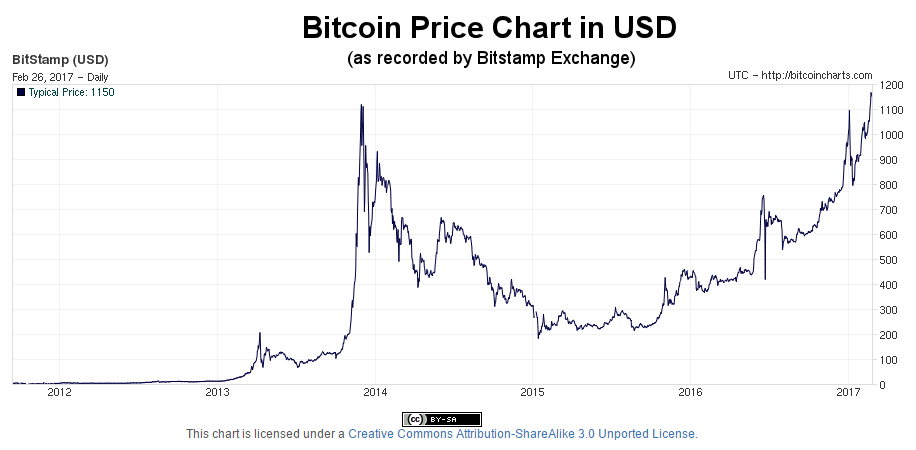

Cryptocurrency bitcoin price

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

Nakamoto created the first Bitcoin on January 3, 2009. Bitcoin was initially mined among tech enthusiasts until the first trading markets for Bitcoin emerged in July 2010, with prices then ranging from US$0.0008 and $0.08. By then, Nakamoto transferred Bitcoin’s network alert key and control of the code repository to Gavin Andresen, who became lead developer at the Bitcoin Foundation.

MicroStrategy has by far the largest Bitcoin portfolio held by any publicly-traded company. The business analytics platform has adopted Bitcoin as its primary reserve asset, aggressively buying the cryptocurrency through 2021 and 2022. As of August 30, 2022, the company had 129,699 Bitcoin in its reserve, equivalent to just over $2.5 billion.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

Bitcoin’s public distributed ledger, or blockchain, is made up of many ‘blocks’, each containing an SHA-256 cryptographic hash of the previous block all the way back to the genesis block mined on Jan 03, 2009.

Top cryptocurrency

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

No, not all top 10 cryptocurrencies on the list are mined like Bitcoin. While Bitcoin uses Proof-of-Work (PoW) mining, others like Ethereum, Cardano, and Solana use Proof-of-Stake (PoS) or other consensus mechanisms where coins are staked, not mined.

Generally, cryptocurrency price data will be more reliable for the most popular cryptocurrencies. Cryptocurrencies such as Bitcoin and Ethereum enjoy high levels of liquidity and trade at similar rates regardless of which specific cryptocurrency exchange you’re looking at. A liquid market has many participants and a lot of trading volume – in practice, this means that your trades will execute quickly and at a predictable price. In an illiquid market, you might have to wait for a while before someone is willing to take the other side of your trade, and the price could even be affected significantly by your order.

The crypto market is not a buzzword anymore; it’s rapidly growing and becoming part of everyday finance. Globally, the crypto market has crossed $2.9 trillion in valuation, and India remains one of the key players in the landscape. According to the latest data by Chainalysis, Central & Southern Asia and Oceania (CSAO) dominate the crypto adoption index, with India ranking first in the region.

Cryptocurrency market

Let’s say that a company creates Stablecoin X (SCX), which is designed to trade as closely to $1 as possible at all times. The company will hold USD reserves equal to the number of SCX tokens in circulation, and will provide users the option to redeem 1 SCX token for $1. If the price of SCX is lower than $1, demand for SCX will increase because traders will buy it and redeem it for a profit. This will drive the price of SCX back towards $1.

ICO stands for Initial Coin Offering and refers to a method of raising capital for cryptocurrency and blockchain-related projects. Typically, a project will create a token and present their idea in a whitepaper. The project will then offer the tokens for sale to raise the capital necessary for funding development. Even though there have been many successful ICOs to date, investors need to be very careful if they are interested in purchasing tokens in an ICO. ICOs are largely unregulated, and very risky.

Cryptocurrencies such as Bitcoin feature an algorithm that adjusts the mining difficulty depending on how much computing power is being used to mine it. In other words – as more and more people and businesses start mining Bitcoin, mining Bitcoin becomes more difficult and resource-intensive. This feature is implemented so that the Bitcoin block time remains close to its 10 minute target and the supply of BTC follows a predictable curve.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

IEO stands for Initial Exchange Offering. IEOs share a lot of similarities with ICOs. They are both largely unregulated token sales, with the main difference being that ICOs are conducted by the projects that are selling the tokens, while IEOs are conducted through cryptocurrency exchanges. Cryptocurrency exchanges have an incentive to screen projects before they conduct a token sale for them, so the quality of IEOs tends to be better on average than the quality of ICOs.